Fillin Station Diner: Lokasi Makan Retro yang Wajib Dikunjungi

Jika sedang mencari pengalaman makan makan yang begitu spesial serta tak terlepas ingatan di Tanah Air, Fillin Station Diner adalah destinasi yang cocok bisa disambangi. […]

Jika sedang mencari pengalaman makan makan yang begitu spesial serta tak terlepas ingatan di Tanah Air, Fillin Station Diner adalah destinasi yang cocok bisa disambangi. […]

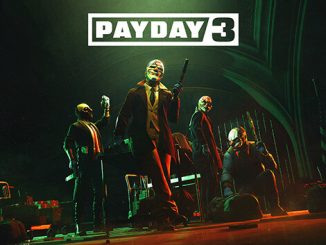

Payday 3 mengundang empat pemain menjadi tim perampok profesional yang melakukan serangkaian heist berbahaya seperti perampokan bank, perampokan kereta, atau pencurian fasilitas militer. Setiap heist menuntut […]

Dalam tengah keragaman kuliner di negeri Indonesia, kuliner Italia telah menemukan posisi istimewa dalam jantung banyak pencinta cita rasa. Tempat makan Indonesia semakin innovatif dalam […]

The Elder Scrolls Online (ESO) membawa pemain ke dunia303 Tamriel yang dikenal dari seri Elder Scrolls seperti Skyrim, Oblivion, dan Morrowind. Dunia ini hadir dalam […]

Setelah bertahun-tahun mendominasi dunia game strategi, seri Sid Meier’s Civilization kembali dengan entri terbarunya: Civilization VII. Game ini menjanjikan perubahan besar untuk membawa pengalaman membangun […]

Super Mario Maker adalah game platforming unik yang memungkinkan pemain untuk menciptakan level Super Mario sendiri dan membagikannya kepada dunia. Dikembangkan dan diterbitkan oleh Nintendo, […]

Sea of Thieves adalah game first-person multiplayer adventure bertema bajak laut, yang dikembangkan oleh Rare dan dipublikasikan oleh Xbox Game Studios. Dirilis pertama kali pada […]

Copyright © 2025 |